Key Takeaways

- HMRC's new online tool helps businesses check if their projects qualify for R&D tax credits before submitting claims

- The tool requires input from a "competent professional" and walks users through all qualifying criteria

- Using the tool and keeping records of your answers can strengthen your position in any future compliance check

- The tool does NOT replace professional advice but provides HMRC's view on whether your project involves qualifying R&D

What Is the New HMRC R&D Qualification Checker Tool?

HMRC has launched an interactive online tool designed to help businesses determine whether their projects meet the definition of Research and Development for tax purposes. This checker is genuinely useful and represents HMRC's attempt to reduce errors and provide clarity upfront.

The tool is available at: gov.uk/guidance/check-if-a-project-includes-activities-that-qualify-as-research-and-development-for-tax-purposes

Who Should Use This Tool?

The tool is specifically designed for:

- First-time claimants who are new to R&D tax relief

- Companies with limited R&D experience unsure whether their work qualifies

- Businesses facing uncertainty about specific projects

- Companies wanting additional support before submitting claims

- Organisations seeking to de-risk their claims amid heightened HMRC scrutiny

Why Has HMRC Launched This Tool Now?

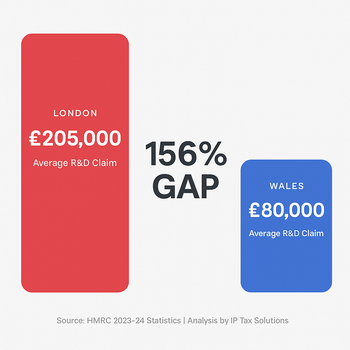

The timing is significant. HMRC's latest statistics reveal a dramatic shift in the R&D tax credit landscape for 2023-24:

The Numbers Tell the Story

- Total claims: 46,950 (down 26% from 65,690 in 2022-23)

- Total relief claimed: £7.6 billion (down just 2%)

- SME scheme claims: 36,885 (down 29%)

- Average claim value: Approximately £161,000 (nearly double the 2021-22 average of £84,000)

Read more about the latest (2025) R&D tax credit statistics here.

This consolidation reflects HMRC's success in weeding out non-compliant claims while preserving legitimate relief. The new tool is part of HMRC's broader strategy to:

- Reduce errors and fraud identified in their compliance reviews

- Provide clarity upfront rather than through retrospective enquiries

- Support genuine innovation by helping businesses self-assess correctly

- Lower compliance costs for both HMRC and claimants

How Does the R&D Qualification Checker Tool Work?

The tool guides users through a series of structured questions covering the fundamental requirements for R&D tax relief. Here's what you need to know about the process:

The Core Questions

The tool examines whether your project:

- Seeks an advance in science or technology - Not just new to your business, but to your field

- Addresses scientific or technological uncertainty - Something a competent professional cannot easily resolve

- Involves systematic investigation - Structured work to overcome the uncertainty, not trial and error

- Creates new knowledge or capability - Demonstrable progress in your field

The Importance of a Competent Professional

HMRC emphasises that you'll need a "competent professional" to answer some questions. This is someone with:

- Relevant technical expertise in your field of science or technology

- Up-to-date knowledge of the current state of the art

- Ability to identify what constitutes an advance and uncertainty in the field

- Professional standing that would be recognized by peers

For most companies, this will be your technical director, lead developer, chief engineer, or equivalent. It's rarely appropriate for finance directors or accountants to answer these technical questions alone.

Recording Your Results

HMRC strongly recommends that you:

- Save or print your result from the tool

- Keep detailed records of the information used to answer each question

- Document your reasoning for each answer

- Store evidence supporting your responses

This documentation becomes invaluable if HMRC opens a compliance check into your claim. As HMRC states: "If your answers in the tool are based on your project's facts and you can clearly support and explain them, we're unlikely to disagree that it involves R&D activities."

What the Tool Does NOT Do

It's crucial to understand the limitations:

Not a Costs Calculator

The tool only confirms whether your project involves qualifying R&D activities. It does NOT:

- Calculate eligible costs

- Determine your claim value

- Identify which expenses qualify

- Replace the Additional Information Form (AIF)

- Provide a substitute for professional tax advice

Not a Safe Harbour

Using the tool does not guarantee HMRC will accept your claim. However, HMRC has stated that if you:

- Answer based on accurate project facts

- Can clearly support and explain your answers

- Keep appropriate records

They are "unlikely to disagree" with your conclusion. If they do disagree, they've committed to explaining why.

How to Use the Tool Effectively: Expert Guidance

Having worked with hundreds of R&D claims over the years, including during my time as a tax partner, here's my professional advice on getting the most from this tool:

Before You Start

1. Gather Your Technical Team

Don't attempt this alone. You need your technical experts involved, not just your accountant or finance team. Schedule a proper session with:

- The project lead

- Key technical personnel

- Someone who understands the wider field (your "competent professional")

2. Research the Current State of the Art

Before answering questions about "advances," ensure you've researched:

- What was already known or available at project start

- What other businesses in your field could already do

- Where the genuine knowledge gaps existed

- What made your approach novel

3. Prepare Project Documentation

Have ready:

- Project plans and technical specifications

- Meeting notes and decision logs

- Records of technical challenges encountered

- Evidence of iterative development or experimentation

- Failed approaches and why they didn't work

During the Tool Session

1. Be Honest and Specific

Generic answers like "we improved efficiency" won't cut it. Be specific:

- What exact uncertainty did you face?

- Why couldn't your competent professional easily solve it?

- What made this an advance in your field, not just new to you?

2. Use the Guidance Links

The tool includes links to additional guidance throughout. Actually read these. They're there to help you understand HMRC's thinking and avoid common mistakes.

3. Think About Evidence

As you answer each question, ask yourself: "Could I prove this to an HMRC inspector?" If not, you may need to reconsider your answer or gather better evidence.

4. Use the Free Text Box

There's an optional free text box when saving your result. Use it to add:

- Context that didn't fit in the structured answers

- References to supporting evidence

- Clarifications on complex technical points

- Links to external validation (publications, patents, etc.)

After Completing the Tool

1. Critically Review Your Output

Does the result align with reality? If the tool says you don't qualify but you're confident you do, this is a warning sign. Either:

- Your project may not actually qualify, or

- You haven't explained it properly

Consider getting professional advice before proceeding.

2. Create a Compliance File

Set up a dedicated folder containing:

- Your tool results

- All evidence used to answer questions

- Technical documentation

- Correspondence about the project

- Any external validation or recognition

3. Integrate with Your AIF

The tool output should inform your Additional Information Form submission. Use consistent language and ensure your AIF reflects the same technical understanding demonstrated in the tool.

What are the most common mistakes when using the HMRC R&D tool?

Mistake 1: Having Finance Answer Technical Questions

The problem: Your FD or accountant answering "Is this an advance in technology?"

Why it fails: They lack the technical expertise to make this judgment. HMRC will not accept a finance professional's opinion on scientific or technological matters.

The solution: Involve your technical lead who understands both your work and the wider field.

Mistake 2: Confusing "New to You" with "Advance in the Field"

The problem: Thinking that because you've never done something before, it must be R&D.

Why it fails: R&D requires an advance in the wider field, not just your company's capabilities.

The solution: Research what was already known or achievable in your field at the project start.

Mistake 3: Poor Record Keeping

The problem: Completing the tool but not saving comprehensive records.

Why it fails: In a compliance check, you'll need to reproduce your thinking and evidence.

The solution: Save everything – the result, your reasoning, all supporting evidence.

Mistake 4: Treating It Like a Tick-Box Exercise

The problem: Rushing through to get a "yes" result.

Why it fails: HMRC will test your answers if you claim. Weak foundations collapse under scrutiny.

The solution: Take time to genuinely reflect on each question. If uncertain, seek professional advice.

Mistake 5: Ignoring a "No" Result

The problem: Getting a "no" from the tool but claiming anyway.

Why it fails: You're now claiming against HMRC's own guidance tool.

The solution: If you disagree with the outcome, get professional advice before proceeding. There may be aspects you haven't properly explained.

Real-World Scenarios: Will Your Project Qualify?

Let me walk you through some examples to illustrate how the tool applies in practice:

✅ Likely to Qualify: Bespoke Algorithm Development

Scenario: A software company developing a new machine learning algorithm to predict customer churn with significantly greater accuracy than existing methods.

Why it qualifies:

- Seeks an advance (improved predictive capability beyond current state of the art)

- Has uncertainty (optimal architecture and training approach unknown at outset)

- Requires systematic investigation (testing different approaches, architectures, hyperparameters)

- Competent professional couldn't easily solve (no established solution for this specific problem domain)

Key evidence: Documentation of approaches tried, why standard methods failed, improvements over baseline, technical challenges encountered.

✅ Likely to Qualify: Novel Manufacturing Process

Scenario: A manufacturer developing a new process to bond dissimilar metals that has never been achieved at commercial scale in their industry.

Why it qualifies:

- Seeks an advance (achieving commercially viable bonding of specific metal combination)

- Has uncertainty (temperature, pressure, timing parameters unknown; risk of failure)

- Requires systematic investigation (controlled experiments, material testing, iterative refinement)

- Creates new knowledge (process parameters not previously established for this application)

Key evidence: Lab notebooks, failed experiments, material test results, comparative analysis with existing bonding methods.

❌ Unlikely to Qualify: Standard Website Development

Scenario: Building a new e-commerce website using React, Node.js, and established frameworks.

Why it doesn't qualify:

- No advance in technology (using well-established tools and approaches)

- No uncertainty (competent web developers know how to build e-commerce sites)

- No systematic investigation needed (following standard development practices)

- Commercially driven, not advancing the field

Why it feels like R&D to you: It's complex, requires skilled people, and you're solving business problems. But that's not the same as R&D for tax purposes.

⚠️ Borderline: Adapting Technology to New Context

Scenario: Applying existing computer vision AI to a novel industrial inspection task that existing solutions can't handle.

Qualification depends on:

- Whether adapting the technology required resolving technological uncertainties

- If a competent professional could easily modify existing approaches

- Whether you're creating new knowledge about applying CV to this specific context

- The extent of novel technical work vs. standard engineering

What the tool will probe: The specific uncertainties, what made this more than routine adaptation, evidence of technical challenges that weren't easily resolvable.

How does the HMRC R&D tool fit into the claims process?

The qualification tool sits within a broader framework of R&D compliance requirements. Here's how it fits:

Timeline for R&D Claims 2025

Before Project Start

- Consider R&D potential during project planning

- Ensure adequate technical expertise and record-keeping

During the Project

- Document technical decisions, challenges, and iterations

- Keep contemporaneous records (not retroactive)

- Maintain clear project boundaries

Project Complete / Accounting Period End

- Use the HMRC qualification tool to verify R&D status

- Calculate qualifying expenditure

- Prepare technical and costing reports

Within 6 Months of Accounting Period End (if required)

- Submit claim notification (if first claim or 3+ years since last claim)

- Not required for merged RDEC scheme

Before CT Return Submission

- Submit Additional Information Form (AIF)

- Complete technical project descriptions

- Provide expenditure breakdown

With CT Return

- Include R&D claim

- Reference AIF submission

- Keep qualification tool results on file

Within 2 Years of Accounting Period End

- Deadline for submitting or amending claim

- Late claims generally not accepted

Building a Defensible Claim

A strong R&D claim in 2025 requires:

1. Robust Technical Narrative

- Clear baseline of knowledge/capability at project start

- Specific advance sought

- Detailed explanation of uncertainties

- Evidence of systematic investigation

- Documentation of outcomes (including failures)

2. Solid Financial Foundation

- Accurate identification of qualifying costs

- Proper allocation between R&D and non-R&D

- Evidence of payment (for subcontractors)

- Compliance with overseas expenditure restrictions

3. Appropriate Professional Involvement

- Competent professional sign-off on technical aspects

- Qualified tax advisor for claim preparation

- Clear separation of technical and financial expertise

4. Comprehensive Documentation

- HMRC tool results

- Project documentation

- Meeting minutes and decision logs

- Technical specifications

- Evidence of uncertainties and how they were addressed

The Future of R&D Tax Relief: What's Coming?

Several developments are on the horizon that businesses should watch:

Advance Assurance Reform

HMRC is consulting (until 26 May 2025) on revamping Advance Assurance to give businesses more certainty over claim eligibility. This could provide:

- Upfront confirmation of R&D qualification

- Reduced compliance check risk

- Greater confidence for businesses

Continued Focus on Compliance

Expect HMRC to maintain pressure on compliance through:

- Targeted enquiries into high-risk sectors

- Greater use of technology to identify anomalies

- Continued emphasis on competent professional involvement

- Possible expansion of mandatory disclosure requirements

Potential Rate Changes

While the current rates are relatively stable, future Budgets could see:

- Adjustments to merged RDEC rates

- Changes to ERIS thresholds or benefits

- Modifications to qualifying expenditure categories

Why Professional Advice Still Matters

The tool is helpful but not a replacement for professional judgment. Here's when you absolutely should seek expert advice:

Scenario 1: Tool Says "No" But You're Confident

If the tool indicates your project doesn't qualify but you believe it does, this likely means:

- You haven't explained it properly for R&D tax purposes

- There are nuances the tool can't capture

- You need to reframe your understanding of the project

A specialist can help you understand whether the work genuinely qualifies or if you're misunderstanding the requirements.

Scenario 2: Complex Projects Spanning Multiple Disciplines

If your R&D involves:

- Multiple technological domains

- Both qualifying and non-qualifying elements

- Collaborative arrangements with other parties

- Substantial overseas components

The tool won't capture these complexities. Professional advice ensures proper treatment of each element.

Scenario 3: First-Time Claimant with Significant Value

If you're claiming for the first time and the potential claim is material (£50k+), the cost of professional advice is modest compared to the risk of getting it wrong.

Scenario 4: You've Received an HMRC Enquiry Letter

If HMRC has opened a compliance check, you need professional representation immediately. The tool won't help you navigate an enquiry.

Market Conditions: Why Now Is Actually a Good Time to Claim

Despite the headlines about falling claim numbers, sentiment in the R&D market is improving for the right reasons:

Signs of Stabilisation After Turbulence

The dramatic compliance crackdown of 2022-2023 hit many businesses hard. Cash flow pressures led some advisors to diversify away from R&D.

But the market now appears to be stabilising. The ' R&D cowboys' have largely been cleared out. HMRC's approach is becoming more predictable meaning that legitimate claimants should now proceed with greater confidence.

Higher-Quality Claims

The consolidation toward fewer, larger, better-documented claims is positive for the industry. It means:

- Reduced competition from spurious claims

- More HMRC resources available for genuine queries

- Greater credibility for the scheme overall

- Better outcomes for compliant businesses

Government Commitment to Innovation

Despite rate reductions, the government has maintained substantial support:

- £7.6bn in annual relief

- Introduction of ERIS for R&D-intensive SMEs

- Consultation on Advanced Assurance improvements

- Recognition of R&D's importance to UK competitiveness

The UK Industrial Strategy, published in June 2025, continues to emphasise innovation as central to economic growth.

How IP Tax Solutions Can Help

As a specialist R&D tax advisor with deep experience across hundreds of claims (including my previous partnership roles at KPMG and Crowe), I provide:

Technical Review and Competent Professional Services

Working with your technical team to:

- Identify qualifying projects you may have overlooked

- Properly articulate the advance and uncertainties

- Document technical challenges appropriately

- Complete the HMRC qualification tool correctly

Claim Preparation and Submission

Full-service claim preparation including:

- Technical report writing

- Costing analysis and verification

- AIF completion and submission

- CT return integration

- Qualification tool documentation

HMRC Enquiry Support

If HMRC opens a compliance check:

- Initial response and strategy

- Information gathering and presentation

- Technical explanation and defence

- Negotiation of outcomes

- Appeals where appropriate

Strategic R&D Planning

Helping you:

- Structure projects to maximise qualifying expenditure

- Implement contemporaneous record-keeping systems

- Train staff on R&D documentation requirements

- Plan multi-year R&D strategies

Frequently Asked Questions

Do I have to use the HMRC qualification tool?

No, it's not mandatory. However, using it and keeping the results provides valuable evidence that you've considered the qualifying criteria carefully. It strengthens your position if HMRC queries your claim.

What if the tool gives an unclear result?

The tool should give a clear yes/no indication. If you're uncertain after completing it, this suggests you may not fully understand the requirements or haven't explained your project well. Seek professional advice.

Can I use the tool for multiple projects?

Yes, you should complete it for each significant project you're claiming. The tool is project-specific, not company-wide.

How long does the tool take to complete?

Typically 20-40 minutes per project, depending on complexity. Don't rush it – thoughtful completion is essential.

What happens if my answer changes after I've claimed?

If you discover an error in your tool responses after claiming, you should consider whether this affects your claim's validity. Material errors should prompt an amended claim. Minor clarifications may be addressed if HMRC raises queries.

Does the tool replace the AIF?

No. The AIF remains mandatory for all claims. The tool is a separate self-assessment exercise, though your tool results should inform your AIF responses.

Can I claim if the tool says I don't qualify?

Technically yes, but you'd be claiming against HMRC's own published guidance. You'd need very strong reasons and professional advice before proceeding. Be prepared for a compliance check.

Is the tool different from the AIF questions?

Yes. The AIF is your formal claim submission requiring detailed project descriptions. The tool is a self-assessment helper focusing on the qualifying criteria. They're complementary but distinct.

What about projects that have both R&D and non-R&D elements?

The tool assesses whether the project includes qualifying R&D activities. In practice, many projects have both qualifying and non-qualifying elements. You can only claim costs relating to the R&D portions.

How does this affect claims already submitted?

It doesn't. The tool doesn't change the R&D definition or qualifying criteria. It's simply a new way to check compliance with existing rules. Claims submitted before the tool's launch are assessed under the same criteria.

What happens if HMRC later disagrees with the tool's result?

The tool's result is guidance only. It does not bind HMRC. If you run a project through the checker and it says the work qualifies, HMRC can still open an enquiry and reach a different conclusion. The tool assesses your answers to its questions, not the underlying evidence. HMRC's caseworkers will look at your technical narrative, cost schedules, and project documentation, not just whether you ticked the right boxes. Save the tool's output as part of your records, but do not treat it as a guarantee.

Does using the tool create an audit trail that HMRC can use against you?

HMRC states that using the tool is voluntary and the answers are not submitted to HMRC. However, if you save the output and later submit it as supporting evidence with your claim, it becomes part of your compliance record. My advice: use the tool internally as a sense-check, but do not attach the output to your claim unless the result clearly supports your position. If the tool flags issues, address them before claiming rather than hoping HMRC will not notice.

How should accountants use this tool with their clients?

If you are an accountant advising clients on R&D claims, the tool is useful as a structured conversation starter. Run through it with the client's technical lead (the competent professional) to identify which projects are strongest and where the gaps are. But do not rely on it as your quality control. The tool cannot assess whether a technical narrative is strong enough to withstand HMRC scrutiny, whether costs are correctly apportioned, or whether the claim structure is optimal. For complex cases or first-time claims above £50k, specialist review adds a layer of protection that the tool cannot provide.

Conclusion: Embracing the New R&D Landscape

HMRC's qualification tool represents a welcome development in the R&D tax credit landscape. After years of uncertainty, increasing compliance activity, and well-publicised cases of abuse, we now have a clear tool for self-assessment.

For legitimate innovators, this is good news. The tool provides:

- Clarity on HMRC's expectations

- Confidence through documented self-assessment

- Protection against inadvertent errors

- Evidence for future compliance checks

The declining claim numbers don't signal a retreat from R&D tax relief – they represent a maturation of the system. The schemes remain generous, worth pursuing and central to UK innovation policy.

However, the rules are more complex than ever. Professional expertise in navigating the merged RDEC scheme, ERIS, overseas expenditure restrictions and contracted-out R&D rules is increasingly valuable.

Use the tool. Document thoroughly. Involve your technical experts. And when in doubt, seek professional advice.

The opportunities remain substantial for businesses genuinely advancing technology. With proper guidance and the right approach, R&D tax relief continues to provide meaningful support for UK innovation.

Take Action Today

Unsure if your projects qualify for R&D tax relief? Contact IP Tax Solutions for a no-obligation discussion about your R&D activities.

With over a decade of specialist R&D experience and backgrounds at KPMG and Crowe UK, we provide clear, commercially-focused advice on:

- Project qualification assessment

- Claim preparation and submission

- HMRC enquiry defence

- Strategic R&D planning

Don't leave money on the table. Ensure your innovation receives the tax relief it deserves.

About the Author

Steve Livingston is the principal of IP Tax Solutions Ltd, a boutique UK tax advisory firm specialising in R&D tax credits and intellectual property taxation. A UK chartered accountant who trained at KPMG and was a partner at Crowe UK, he has prepared and defended hundreds of R&D claims across diverse sectors since the firm's founding in 2012. IP Tax Solutions Ltd is regulated by Institute of Chartered Accountants in England & Wales.

This article was last updated in October 2025 and reflects the latest HMRC guidance and R&D tax relief statistics. R&D tax rules change regularly – always verify current requirements before claiming.