What's Changed?

Since April 2023, HMRC requires advance notification before you can claim R&D tax relief. Miss this step, and your entire claim becomes invalid—even if your R&D activities are genuine.

Do You Need to Pre-Notify?

YES, if your accounting period starts on/after 1 April 2023 AND:

- This is your first R&D claim, OR

- You haven't made a valid R&D claim in the past 3 years

NO, if:

- You've made a valid R&D claim within the last 3 years (careful here, especially where there might be amended returns...)

- Your accounting period started before 1 April 2023

Critical Deadline ⚠️

You have 6 months after your accounting period ends to submit notification.

Examples:

- Period: 1 Jan 2024 → 31 Dec 2024 | Deadline: 30 June 2025

- Period: 1 Apr 2023 → 31 Mar 2024 | Deadline: 30 Sept 2024

Late submissions are almost never accepted.

We've created a handy tool for you to use (not a substitute for professional advice) to check whether you need to pre-notify HMRC. You'll find it below👇

What You'll Need to Pre-Notify HMRC

- Company UTR

- Senior officer details

- Agent details (if using one)

- Accounting period dates

- Brief description of R&D activities

💡 If Unsure: Notify Anyway

Not 100% sure if you'll proceed with a claim?

Submit the notification regardless. There's no penalty for notifying then deciding not to claim, but missing the deadline kills your entire claim.

You are of course giving HMRC an advance 'heads up' of your intended claim and they may be alerted if they think your industry and/or your activities look doubtful, but this should not deter legitimate claimants.

Also, take care with the 'brief description' to ensure factual accuracy.

Important Caveats About This R&D Pre-Notification Tool

🚨 This tool is for guidance only and should not replace professional advice.

Key Limitations:

- Complex situations involving multiple claims, group companies, or unusual accounting periods may need specialist review

- HMRC's own guidance has been inconsistent—rules around amended claims changed in late 2024

- Three-year look-back calculations can be intricate, especially with mixed original/amended filings

- Date calculations assume standard scenarios—leap years and month-end variations may affect deadlines

Always Consider Professional Help If:

- You have multiple overlapping claims

- You've made several amended returns

- Your accounting periods don't align with calendar years

- You're part of a group structure

- You're uncertain about R&D qualification

Remember:

- Save your notification confirmation—you can't access it later

- Set calendar reminders for future deadlines

- When in doubt, notify early—better safe than sorry

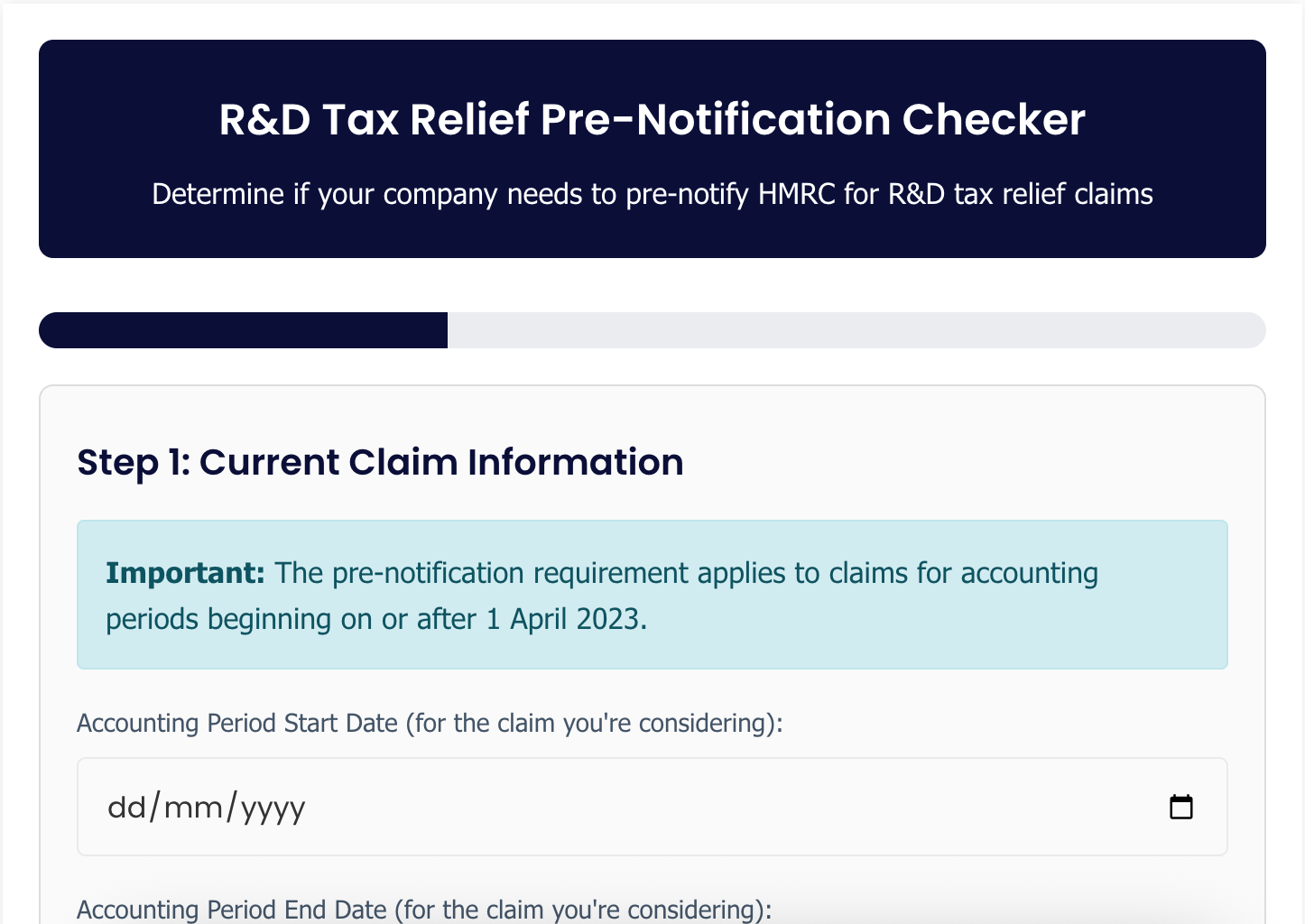

R&D Tax Relief Pre-Notification Checker

Determine if your company needs to pre-notify HMRC for R&D tax relief claims

Step 1: Current Claim Information

Step 2: Previous Claims History

Previous Claims Details

Step 3: Results

Important Reminders:

- The deadline for pre-notification is strict. Missing it generally invalidates your R&D tax relief claim.

- Late pre-notifications may be accepted in very limited circumstances, but this is rare.

- If unsure, it's recommended to submit a pre-notification - there's no penalty for notifying and then deciding not to claim.

- For complex situations or if you're uncertain, seek professional advice.

What you'll need for the actual pre-notification:

- Company UTR (Unique Taxpayer Reference)

- Senior officer details

- Agent details (if applicable)

- Accounting period and period of account dates

- Summary of planned R&D activities

No reliance should be placed on the results from this tool without seeking specific professional advice - it is for high-level guidance purposes only

Bottom Line: This notification is now a non-negotiable first step for many R&D claims. The 30 minutes spent on notification could protect £000's in tax relief.

Don't let administrative oversight derail your innovation funding.

Reach out if you need help or would like to explore further.