With effect from 6 April 2021, it is a requirement that companies must file a new form with their CT600 corporation tax return in order to claim R&D tax relief.

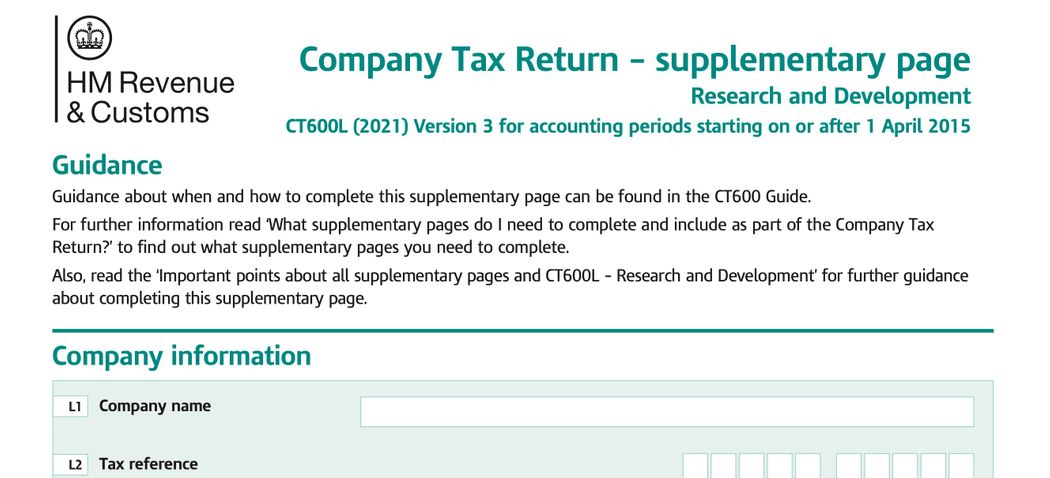

This new form, called CT600L, is a supplementary form that must accompany the existing main CT600 form for an R&D tax relief claim to be considered full and complete.

It applies for both the SME R&D tax relief and the Research and Development Expenditure Credit (RDEC).

In fact, the form is primarily concerned with the RDEC relief (as opposed to the SME relief) as the majority of the form covers the various hoops that all claimants must jump through to successfully qualify for RDEC relief.

It will be interesting to see how hardline HMRC's approach is to enforcing the completion of this new additional form - particularly as it has not been very well publicised plus the majority of tax software programmes have yet to implement it!

I suspect that in the short-term we might see HMRC accelerating the processing of those claims that successfully filed the new form ahead of those that do not...