R&D Tax Credits

R&D tax credits for the Construction Sector

Construction companies across the UK might be missing out on a generous form of funding - the R&D tax credit. Here we explore how this government tax relief might apply to the construction industry...

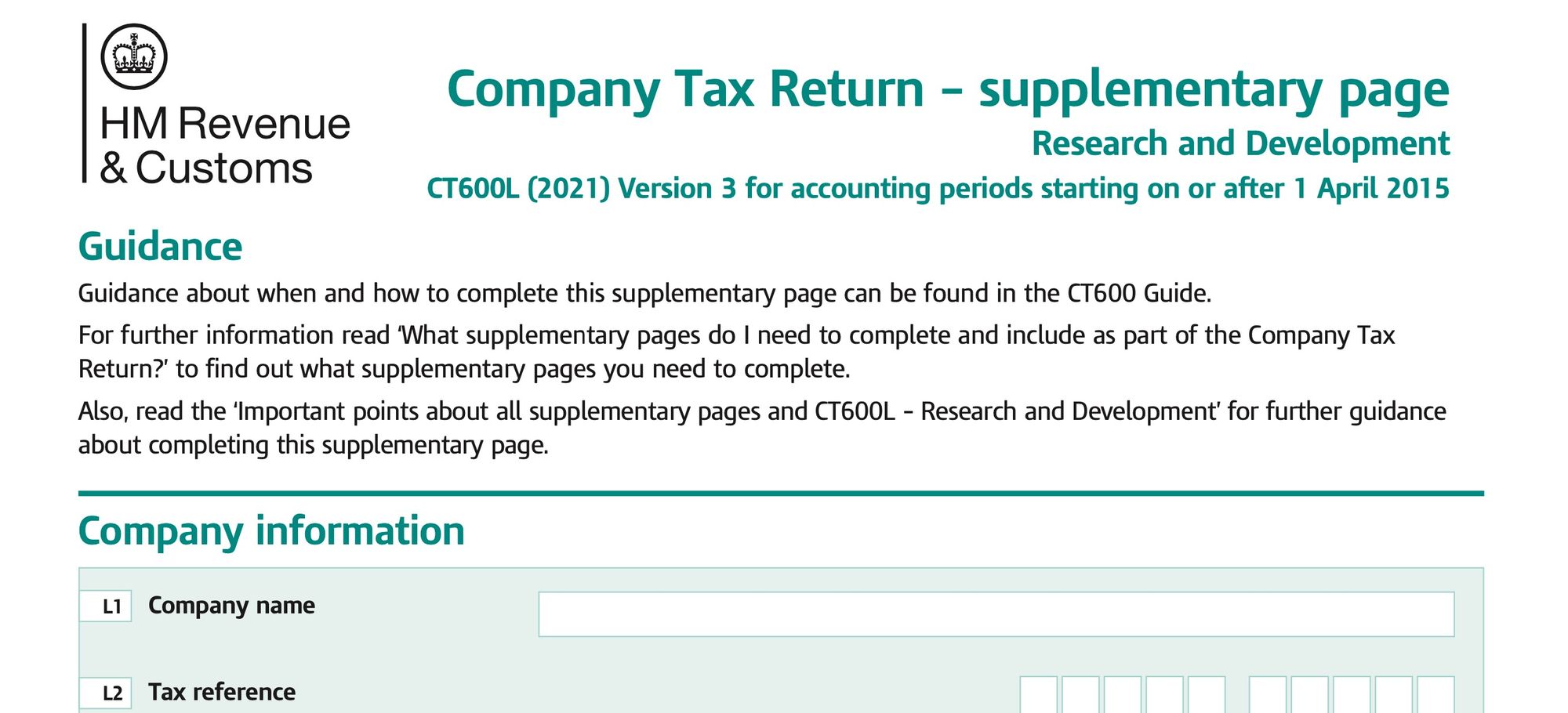

R&D Tax Credits: New Form required from 6 April 2021 (CT600L)

HM Revenue & Customs has introduced a further form that all companies must now complete and file when claiming either the R&D tax credit relief

R&D Tax Credits: Claiming Relief for Loss-Making Companies

There is a common misconception that R&D tax relief doesn’t apply to loss-making companies because “they don’t pay tax”. This could not be further from the truth: loss-making companies can actually secure better cash tax savings than profitable companies. Here we explore how

R&D Tax Credits - Who is eligible and what qualifies

An introduction to the UK R&D tax credit incentive that can provide cash tax savings for profitable or loss-making companies that are seeking to develop new or improved products or services

10 benefits of embedding innovation into your workplace

Although helping companies navigate and claim R&D tax credits is a core service that we provide, the largest and most robust claims leave clues (hint: its in the culture of innovation within the business)

R&D Tax Credits Explained: Who is eligible and what costs qualify?

The UK R&D tax credit incentive is becoming more popular but the rules can be tricky to navigate in terms of who is eligible and what costs qualify

How do you claim R&D tax credits?

The R&D tax credit scheme is a key driver of innovation funding amongst UK businesses. It is administered by HMRC and is claimed by companies via your company tax return. It is important that you also include the supporting documentation that HMRC expect to see...

SME R&D Tax Credits Example Calculation: How to apply 230% enhancement

Here we walk you through the steps necessary to calculate an R&D tax credit claim under the SME scheme

How to account for R&D tax credits in your financial accounts

In this short video, we cover how to account for the benefit of UK SME R&D tax credits in your company accounts.

RDEC Scheme: Guide to the UK Research & Development Expenditure Credit

In this article, we provide a detailed guide to everything you need to know about the UK Research and Development Expenditure Credit – more commonly known as the “RDEC” for short.

Am I too late to claim R&D tax credits?

Many company founders mistakenly believe that they are too late to make a claim for R&D tax credits because they have already filed their tax return - this could be a costly mistake...

Impact of Dividend v Salary on R&D Tax Credits for a Director

A common problem for R&D tax credit claims is where a director shareholder (who is involved in the R&D work) has structured their remuneration as a low salary and the remainder as dividends.

Staffing Costs: Common pitfalls for R&D tax credits

Staffing cost are a key cost for many companies claiming R&D tax credits. But there can be some pitfalls and traps for the unwary...

What qualifies for R&D tax credits for software development companies?

Software development companies can benefit from the UK Government’s R&D tax credit relief incentive

5 R&D Tax Credit Tips for UK Software Companies

Here we share five R&D tax credit tips for UK based software development companies including overseas subcontractors, grants, past projects and staffing costs.

Software R&D Tax Credit Claim: HMRC success in Tribunal Case

This tribunal case involves some useful reminders on the importance of competent professionals and the need for substantive evidence to support R&D tax claims

R&D Tax Credits & COVID-19: Impact of CJRS and Furlough

On 10 September 2020, HMRC issued their view on how the R&D tax credit relief will be applied to furloughed employees under the Coronavirus Job Retention Scheme (CJRS)

PAYE Cap: New Rules for SME R&D Tax Credits announced by HMRC

A new PAYE cap will be introduced in 2021 to limit payable R&D tax credits to £20,000 plus 300% of the company’s total PAYE & NIC liability for the period

Video Games Tax Relief or R&D Tax Credits - Which can I claim?

Video Games Development companies can benefit from either the Video Games Tax Relief (VGTR) or the R&D tax credit - but the decision which to choose is not quite so straightforward...

Seed Enterprise Investment Scheme (SEIS) / Enterprise Investment Scheme (EIS)

Issue SEIS shares first, followed by EIS shares after (always!)

A potential costly error for Founders of startups is to miss the technical point that SEIS shares must be issued before EIS shares

How to apply for SEIS or EIS HMRC Advance Assurance

Here we provide a comprehensive ‘hands-on’ overview on how to apply for SEIS EIS HMRC advance assurance aimed at entrepreneurs and founders.

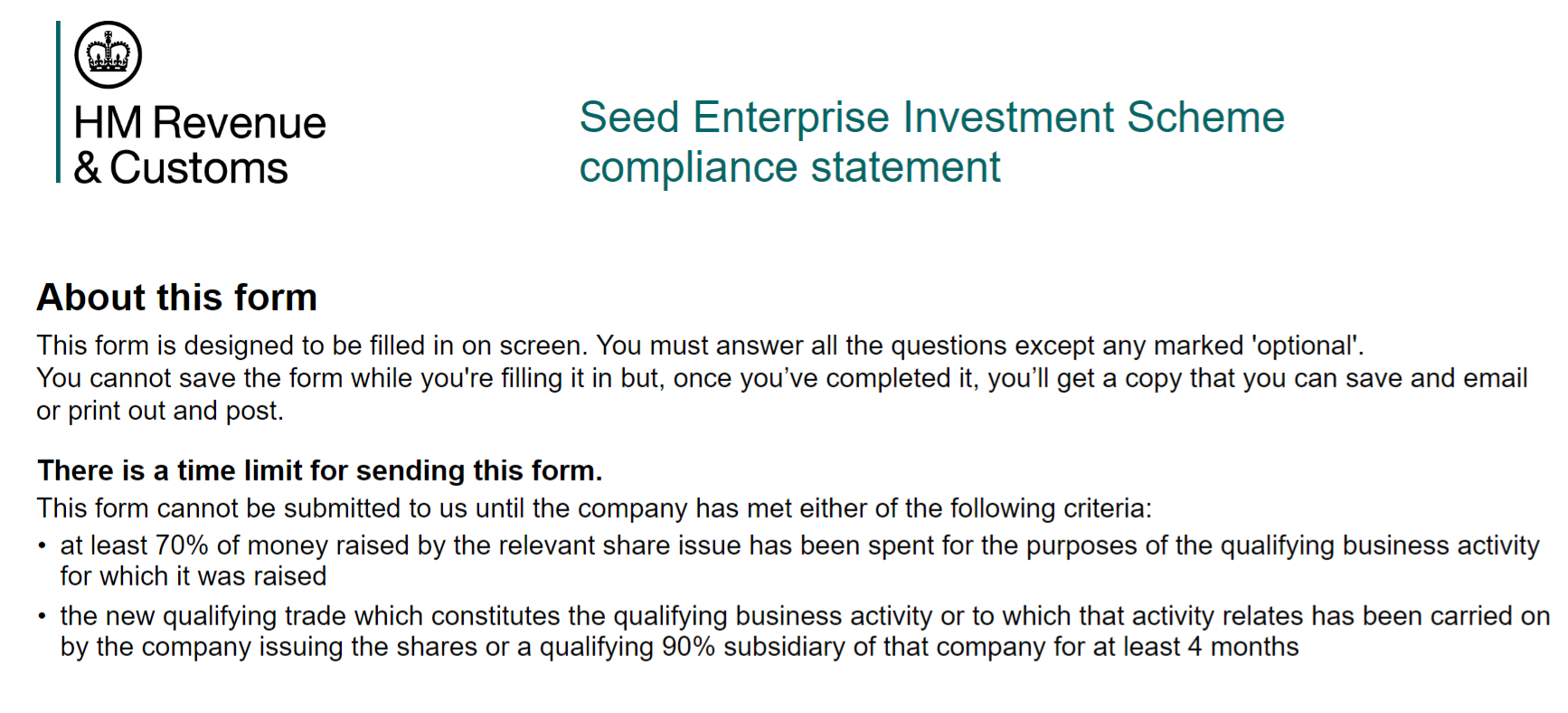

HMRC: SEIS1 Form

Unfortunately it is not all over once you have successfully secured HMRC advance assurance and issued the shares. You next need to complete and file form SEIS1

How to Supercharge your SEIS / EIS Funding

Raising funding under the SEIS or EIS can generate significant cash savings for the investors but more can be achieved - if you know how...

Software Company Denied SEIS Advance Assurance Solved

A Uni spin-out purchased software to develop it to license out to customers. It intended to raise SEIS funding but its advance assurance application was rejected by HMRC under the excluded activities test.

SEIS: How to claim income tax relief in the prior tax year

So you have made an investment into an SEIS company but you don’t want to claim (all of) the income tax relief in the latest tax year - how do you carry it back?

Self Assessment / Personal Tax

Self Assessment: Deferment of 31 July 2020 tax payment (COVID-19)

As part of the range of COVID-19 financial measures, a deferment of the second payment on account for personal tax self assessment payments was announced...

31 January Self Assessment Tax Filing Deadline - HMRC changes

The 31 January filing and payment deadline for personal tax self assessment returns had not changed despite the COVID-19 pandemic - let’s have a grumble...[Update: HMRC introduced a relaxation to the 28 Feb 2021 for filing of returns, shortly after this post went live]

Team

Cycle to Work Scheme: Can you claim for electric or ebikes?

With the recent COVID pandemic, bicycles have become ever more popular. Not just for keeping fit during lock-down but increasingly as a preferred mode of transport for commuting...